An approved individual under the Returning Expert Programme who is a resident is taxed at the rate of 15 on income in respect of having or exercising employment with a person in Malaysia. For example lets say your annual taxable income is RM48000.

Borang Tp 1 Tax Release Form Dna Hr Capital Sdn Bhd

On the First 5000.

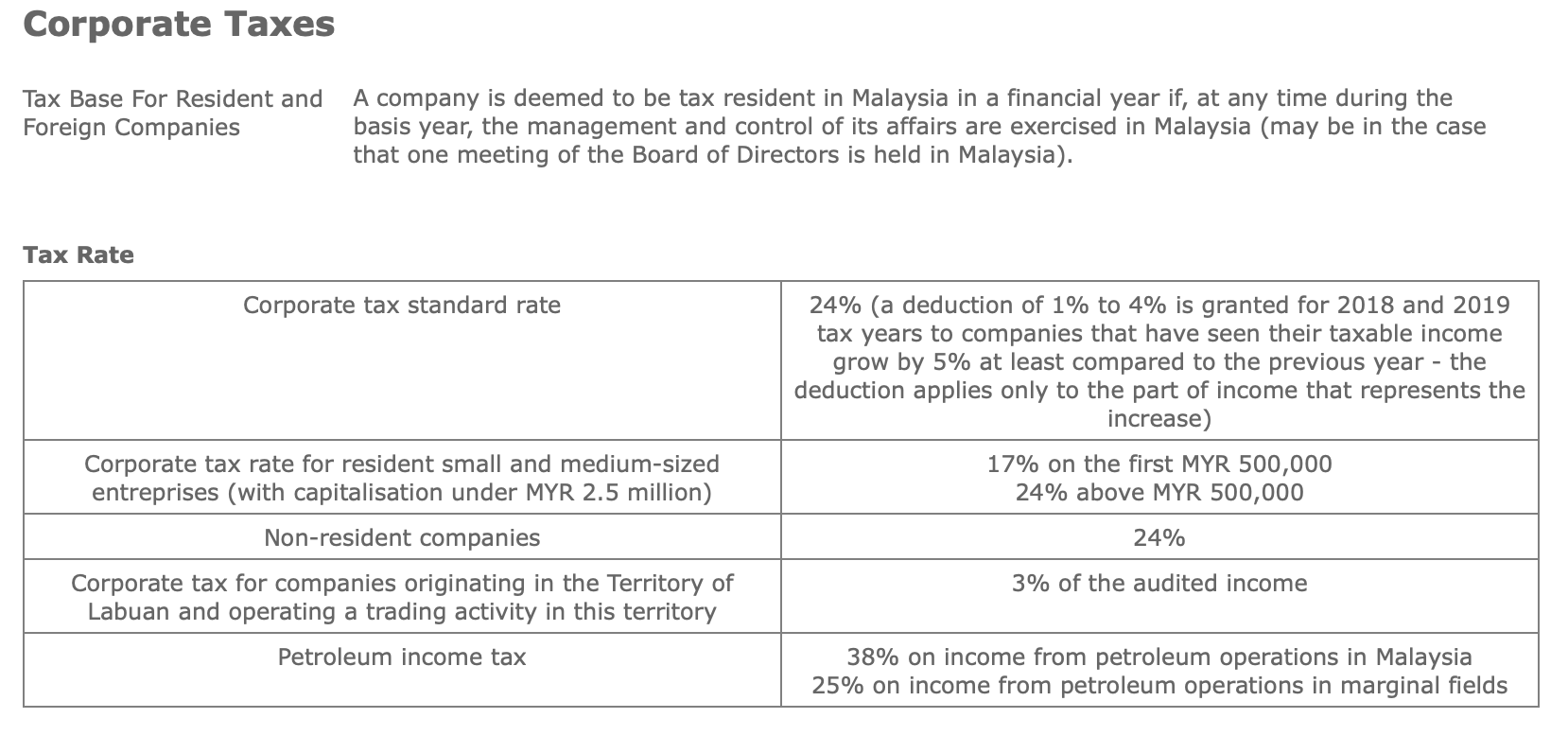

. On first RM600000 chargeable income 17 On subsequent chargeable income 24 Resident company with paid-up capital above RM25 million at the beginning of the basis period 24. Income tax deductions for contributions made to any social enterprise subject to a maximum of 10 of aggregate income of a company or 7 of aggregate income for a person. Based on this amount the income tax to pay the government is RM1640 at a rate of 8per cent.

The deadline for filing income tax in Malaysia is April 30 2019 for manual filing and May 15 2019 via e-Filing. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Rates Real Property Gains Tax Stamp Duty Sales Tax Service Tax Other Duties Important Filing Furnishing Date Contact Us Disclaimer 20182019 Malaysian Tax Booklet.

It should be noted that this takes into account all your income and not only your. Calculations RM Rate TaxRM A. On the First 5000 Next 15000.

However if you claimed RM13500 in tax deductions and tax reliefs your. 30 on over 2 million MYR. A specific Sales Tax rate eg.

The income tax in Malaysia for non. Here are the income tax rates for personal income tax in Malaysia for YA 2019. Effective from 1 January 2020 individuals who are not Malaysian citizens are subject to RPGT at a rate of 30 for a holding period up to five years and 10 for a holding period exceeding five.

This translates to roughly RM2833 per month after EPF deductions or about RM3000 net. 28 on the next 1 million between 1000001 and 2 million. The rate of tax for resident individuals for the assessment year 2020 are as follows.

Increase to 10 from 5 for companies Increase to 5. 13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable income. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia.

26 when the income is between 600001 and 1 million. An effective petroleum income tax rate of 25. 030 Malaysian ringgits MYR per litre is applicable to petroleum products.

The tax rate for 20192020 sits between 0 30. With the Budget 2019 the RPGT for disposal of real estate from the 6th year of ownership onwards will be increased. For non-residents in Malaysia the income.

Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the. Based on this amount the income tax to pay the. Tax deduction not claimed in respect of expenditure incurred that is.

One of the key proposals in this years Budget is the increase in individual income tax rate highest band from 28 percent to 30 percent for resident individuals with chargeable. There are exemptions from Sales Tax for certain persons eg. Petroleum income tax Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia.

If taxable you are required to fill in M Form.

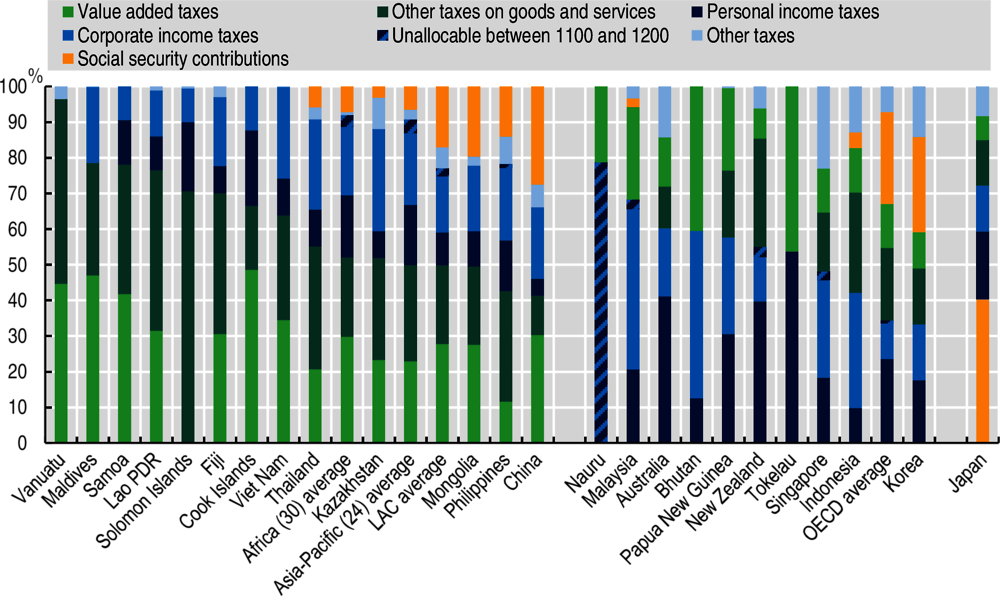

1 Tax Revenue Trends In Asian And Pacific Economies Revenue Statistics In Asia And The Pacific 2021 Emerging Challenges For The Asia Pacific Region In The Covid 19 Era Oecd Ilibrary

How Do Taxes Affect Income Inequality Tax Policy Center

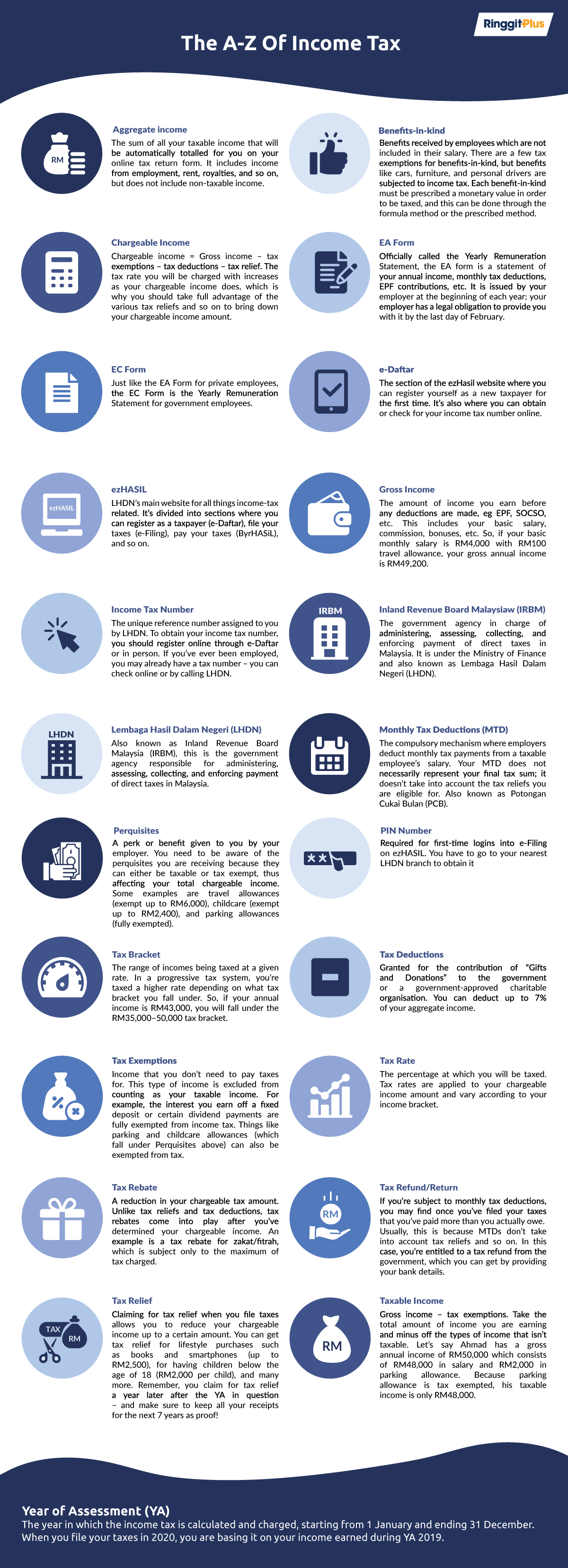

Malaysia Income Tax An A Z Glossary

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Real Property Gains Tax Rpgt In Malaysia 2022

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

2019 Real Estate Tax Rates Charlottesville Solutions

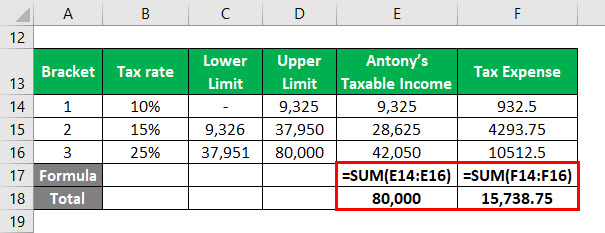

Effective Tax Rate Formula Calculator Excel Template

What Is The Difference Between The Statutory And Effective Tax Rate

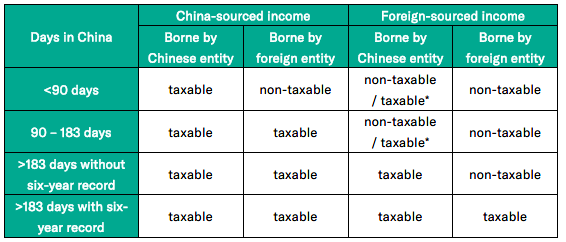

The Revolution In China Individual Income Tax Law As Of 2019 Rodl Partner

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done Stocknews

Corporate Tax Rates Around The World Tax Foundation

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Income Tax Malaysia 2018 Mypf My

1 Tax Revenue Trends In Asian And Pacific Economies Revenue Statistics In Asia And The Pacific 2021 Emerging Challenges For The Asia Pacific Region In The Covid 19 Era Oecd Ilibrary

10 Things To Know For Filing Income Tax In 2019 Mypf My

Taxing High Incomes A Comparison Of 41 Countries Tax Foundation